1937.

Since 1936, the Industrial Tax Exemption Program (ITEP) has been a tool used by Louisiana to lure business and industry to set up shop in Louisiana. The idea is that if businesses are free from the liability of property taxes, they can reinvest more capital into growth and expansion. In turn, this creates jobs, and when jobs are created, unemployment goes down and sales tax revenue goes up.

At the time that ITEP was implemented, Louisiana was largely agrarian and rural with large industries settling near incorporated areas and creating a booming economy where there was none, before. Over the years, Louisiana has become increasingly more dependent on business, industry, oil and gas; and less dependent on agriculture. In order to maintain a booming economy, industrial expansion must be perpetual. As a result, what once were rural communities surrounding incorporated areas begins to get swallowed up as urban cities expand and the suburbs reach farther and farther out. The biggest downfall to an economic boom is that the room for expansion is not infinite. All booms eventually go bust.

The ITEP program, combined with the current state income tax table, puts the burden of generating state tax revenue entirely on the backs of the middle class and working class citizens of Louisiana. Simply put, business and industry pays almost no property tax and very little income tax. The entirety of the State’s revenue depends on the ability of its citizens to make purchases and pay sales taxes.

I know there are those who believe that economic theory is proof enough that a state climate that favors business is what drives a strong economy, but when you acknowledge that Louisiana grants industrial exemptions at a rate of ten times more per capita than any other state, and we are facing a $1 billion dollar deficit, you cannot justify adhering to that theory.

The reason I chose to write about this is to illustrate its relationship to education reform. The Louisiana Association of Business and Industry (LABI) is, and has been, the primary driver of the economic approaches that I described, above. They have enormously deep pockets of money funded by industries, and they lobby the state legislature with much success. In addition, LABI is also a dominant driving force behind education reforms in Louisiana. They lobby for school choice which includes weakening teacher unions; implementing invalid teacher evaluations; and rating students, teachers and schools using an unreliable test and arbitrary scale of achievement. All of this serves to label schools as failing, create opportunities for charter schools and voucher programs, and not so much reduce the size of government, but instead, divert the money spent to profits for private entities.

Each year, we hear the same arguments at the legislature about the budget. “We don’t have a revenue problem. We have a spending problem.” I disagree.

I don’t believe we have a spending problem. We have a priority problem.

Think for a minute about how these policies are affecting our public schools. Year after year, the budget gets cut to make up for shortcomings in revenue. These shortcomings could easily be eliminated by reducing industrial exemptions by half. Industrial exemptions rob local districts of revenue. Lower local revenue, in turn, creates more reliance on state contribution to the MFP which determines the per pupil spending in education. In contrast, if fewer exemptions were granted there would be more local contribution; less state contribution.

Next, charter schools and vouchers take money out of the school system. The per pupil spending goes with the student. With each student that leaves a district, approximately $11,000 goes with them. These two things combined leave districts struggling to meet unattainable expectations with less and less money available to spend. Since the very first charter schools in Louisiana, public schools have outperformed charters, as a whole. Is LABI’s goal really about student outcomes, or is it about better profit opportunities for business and industry?

Recently, Gov. John Bel Edwards issued an executive order regarding ITEP which limited it to a 5 year 100% exemption and 5 year renewal at 80% if, and only if, the end result of the exemption is job creation, and the local governments approved of the exemption. I’m going to focus on Calcasieu Parish because it is my home, and I understand the dynamics of it better than any other parish in the state. Just a few weeks ago, the Calcasieu Parish School Board approved a request for exemption from Phillips 66. The request was granted, unanimously, with few questions and little discussion. The five year exemption amounts to just under $15 million. In exchange, Phillips 66 will create 150 temporary construction jobs and two (2) permanent jobs. Yes. TWO.

Phillips 66 has received 86 exemptions since 1999 at a cost of $97.9 million and a net job loss of 104 jobs. We gave them $98 million to reduce their payroll by 104 people, and so by granting the latest exemption, they are at -102 jobs.

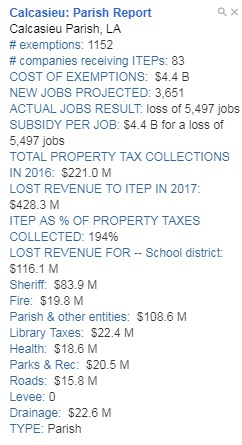

You can see in the graphic on the right, Calcasieu Parish, as a whole, has granted 1152 exemptions to 83 companies for a total loss in revenue of $4.4 billion. These exemptions projected 3,600 new jobs, but actually resulted in 5500 jobs lost. The total exemptions given exceeded the total property taxes collected by $207 million. The total loss in revenue to Calcasieu Parish School Board in 2017 is $116 million dollars. With half of that amount, we could build a new school, or fund universal Pre-K.

Many states have programs similar to ITEP, but several states have slightly different models that prioritize education. Texas, for example, grants 100% exemptions minus the portion that goes to school districts. I don’t believe that model would benefit Louisiana school districts because of the way the MFP (per pupil funding) is set up. If business and industry had to pay the portion of property tax that goes to school districts, then the local contribution would increase, and the total per pupil spending would be a wash.

Here is an idea that I think the legislature needs to explore to determine whether LABI truly supports the school choice movement for improved student outcomes, or for profit. If LABI wants industries to have exemptions, and they want to support school choice, then exemptions should exclude the portion going to school districts AND, reimburse districts for MFP money lost when students choose a charter or voucher and take their MFP with them. The end result? School districts wouldn’t be starved, and if school choice can truly deliver on its promise, it doesn’t weaken the choice already made by more than 90% of parents in Louisiana.