In Part 1 of this blog, I explained the Industrial Tax Exemption Program (ITEP) and how it tilts the economy in favor of business/industry. In the closing, I stated that returning the economy to a more balanced state isn’t as simple as reining in ITEP. I hope to explain my reasoning, here, in Part two.

To illustrate, I’m going to stick with things that are specific to Calcasieu parish, which is where I live, and how it applies to K-12 education, which is where I work. What I am going to explain can be observed in what are considered to be Louisiana’s richest parishes; Jefferson, East Baton Rouge, St. Tammany, Caddo, Calcasieu, and an anomaly in Cameron.

Louisiana’s economy is a living example of what you would call “trickle-down” economics. There are many different economic theories, and in general, they tend to favor business to varying degrees. Any theory that attempts to balance its benefits equally between business and citizens is generally denounced as anti-business, or socialism. Trickle-down economics is a conservative, or Republican, ideal that mostly came to light under President Reagan. The general idea behind trickle-down is that when businesses are free of government restraints, they are able to increase profits, reinvest in their business, hire more people; therefore, creating a thriving economy. In order to accomplish this, there has to be a reduction in government’s reliance on tax revenue. This is generally done through business exemptions on income and property; however, like most theories, it doesn’t play out as well in practice.

Over the last few decades, the business and industry lobby has successfully shifted funding for local government from revenue that is generated through stable property taxes which has relatively few ups and downs over the long term to revenue generated by volatile sales which is subjected to the less predictable whims of the economy.

In October, I wrote about how the MFP Formula violates the law. In summary, in 1992 there was an effort led by business and industry to make basic changes to law and policy to benefit themselves. Essentially, the intent was to reduce homestead exemption, repeal a law that prohibited using sales taxes to calculate the MFP and change the MFP formula to include sales taxes. Ultimately, the homestead exemption wasn’t changed, and the law wasn’t repealed, but the MFP formula was changed. For twenty-six years, the MFP formula has illegally included sales tax. Obviously, there’s grounds here for litigation, and I’m told there has been a suit filed that will not move forward because the involved parties understand that correcting this wrong would bankrupt the state. So, business as usual. The only real way to correct it would be to reduce ITEP, roll back sales taxes, and then correct the MFP formula. Good luck with that.

Under the leadership of Governor Bobby Jindal, the ITEP program was injected with steroids. Corporations regularly received far more incentives than they asked for, and in all of the “rich parishes” mentioned above, local business and industry began to come out in support of additional sales taxes which took the form of a half cent here and a half cent there to make up for the reduction in revenue from property taxes. Many school districts used additional sales tax to provide supplements to their teachers. Some made the mistake of rolling those supplements into the adopted pay scale. This means that if the economy goes bust, that revenue dies, and they will be forced into a workforce reduction. If teacher salaries were more dependent on stable revenue such as property taxes, a workforce reduction is less likely because property values don’t generally go down dramatically.

Why is this important? It is important because in the mid-90s, the fledgling ITEP program was gaining interest. If business and industry were to take advantage of it, the current tax structure and MFP formula would have to be changed, or local school districts would experience significant reduced revenue.

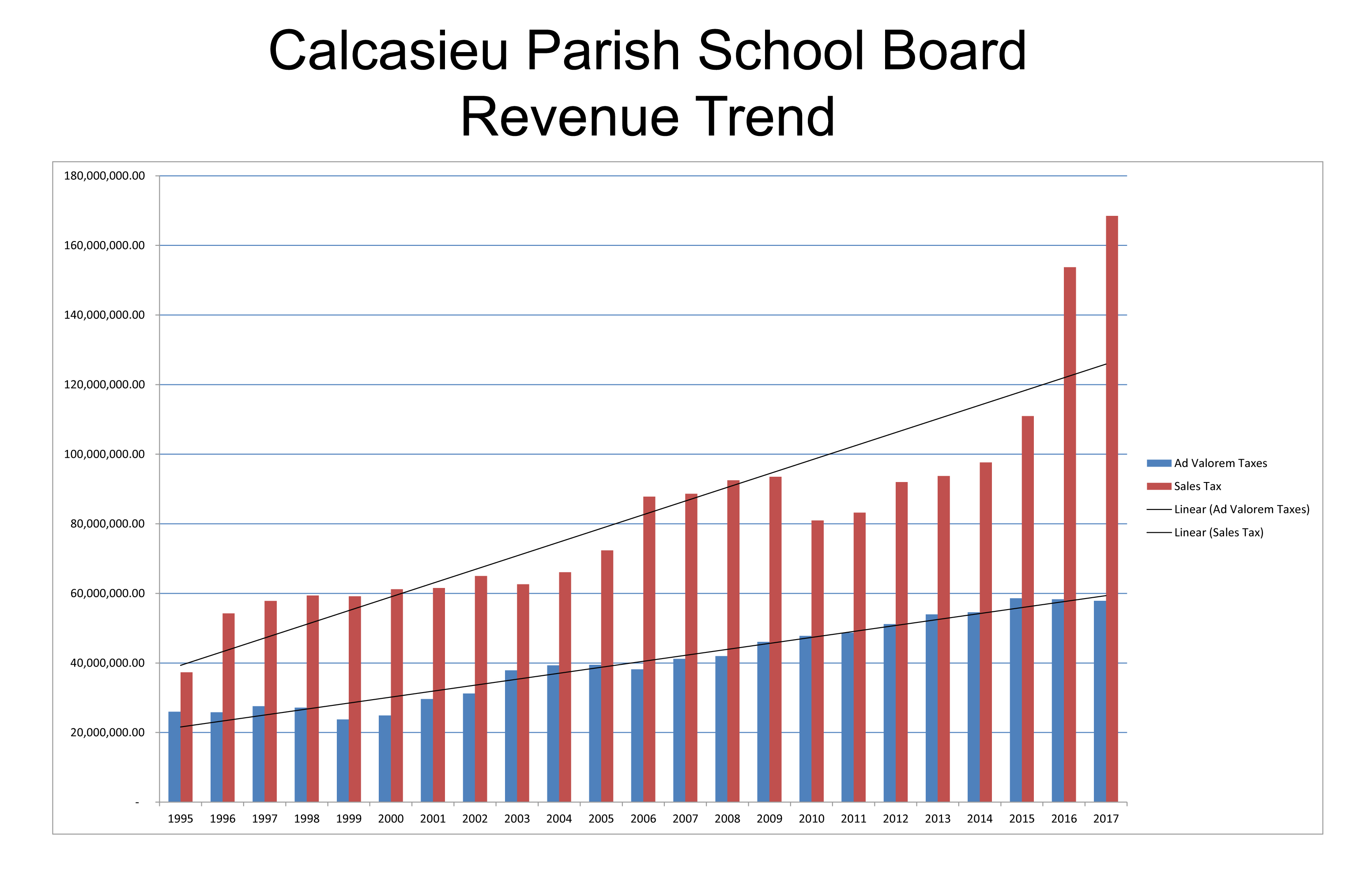

The chart above illustrates the Calcasieu Parish School Board’s local tax revenue from 1995-2017. You can see where sales tax revenue nearly doubles in 1996 due to the passage of a 1/2 cent sales tax intended to offset losses from the new MFP formula. Sales tax revenue continues to rise, but property tax revenue stays level and even drops in 1999, the first year that Phillips 66 received an ITEP exemption. In 2006, there’s another dramatic increase in sales tax revenue, but it’s due to recovery from Hurricane Rita. Post Hurricane Rita, the cost of housing in Calcasieu parish increased dramatically, but property tax revenue only had moderate increases. Finally, in 2010, the economic boom hit southwest Louisiana. The cost of housing ballooned. Apartment complexes and residential subdivisions with $500K homes are still being built in every rice field in the parish, yet property tax revenue increases remain moderate. In 2015, the voters passed an arguably unnecessary additional half cent sales tax for teacher salaries, and sales tax revenue explodes. In real percentage numbers, property tax revenue has increased 223% from 1995 to 2017, despite an enormous increase in home value and number of homes, while sales tax revenue has increased 452%. Meanwhile, Driftwood LNG has received a two billion dollar property tax exemption.

So, what about that Cameron parish anomaly? Well, although nowhere near being the richest parish, Cameron parish has historically led the state in ITEP exemptions. Up until the approval of the Driftwood exemption, Calcasieu parish was number two. Since Hurricane Rita, Cameron parish has relatively few residents. Many people left and never came back. This means that they have zero in sales tax revenue. I’m not kidding. In the spreadsheet provided by LDOE, in every year since 2004, Cameron parish has no sales tax revenue worthy of including in the MFP formula. So, Cameron parish has been leading the state in ITEP exemptions, has no sales tax base, the state pays the entirety of its MFP, and as a result, the school board is currently operating in a $2,000,000 deficit. But, HEY! The economy is booming.