Two years ago, I started this blog in an effort to educate parents, teachers, and community members on the education reforms that are perpetrated on our public schools by corporate interests, and how they affect our students, parents, and teachers. For decades, business and industry has feigned efforts to address civil rights issues in education by introducing education reform components that return no measurable improvement in educational outcomes while using the reforms to meet their own corporate goals that have no connection to education.

The components of education reforms, and the motives and outcomes of corporate efforts are far too vast to discuss in one blog. If you would like to understand them more, I would urge you to scroll back through all of my previous blogs. Today, I’m going to talk specifically about Industrial Tax Exemptions (ITEP) which allows the abatement of all, or part, of a company’s property tax liability.

The talking points from those in favor of ITEP include “incentivizing” business/industry to locate in Louisiana, “the creation of jobs,” and a “stimulated economy,” but the reality is that decades have been spent shifting an entire state’s economy into one that has moved away from stable and predictable property tax and income tax revenue sources to support government and government services, including schools, to an economy more dependent on sales tax revenue and an economic model that requires constant growth in a finite space.

Since Gov. John Bel Edwards took office, the Industrial Tax Exemption Program (ITEP) has been under scrutiny. Nary a week goes by without a front page article about ITEP on one, or all, of the major newspapers in the state. There has been much hoopla about the changes made by Edwards, the push back from business and industry, and the plans that Baton Rouge area legislators have to roll back the changes.

Let me first clear up something. Edwards made no changes to the program. What he did was issue an executive order requiring ITEP applications to first be approved by local taxing authorities before reaching his desk for final approval. This is a requirement that is set forth in the Louisiana Constitution, but has largely been disregarded for decades. All he did was require the law to be followed. Later, in an effort to increase the likelihood of the governor’s approval, the State Board of Commerce and Industry adopted new rules that limited the abatement to a maximum of 80% of the tax liability.

It is important to understand that when legislators say they want to pass a bill to “roll it back,” what they really mean (or maybe don’t know) is they want a constitutional amendment that takes authority away from locals and allows Baton Rouge to forego the revenue that you authorized your local government to levy to pay for services. Constitutional amendments have to be approved by the voting public, and I don’t think the people of Louisiana will approve of that. This is also another reason certain interests are pushing for a constitutional convention. Those who control the agenda and process, also control the outcome. This is why I think it is time to propose a different constitutional amendment.

In 2005, Greg LeRoy published his book, The Great American Jobs Scam: Corporate Tax Dodging and the Myth of Job Creation. Among the dozens of insightful takeaways in the book, I found these the most intriguing.

- When interviewing the most successful CEOs in the country, he learned that in the hierarchy of things to consider when investing in a new production site, subsidies/incentives were at the bottom of the list. While the overall tax burden of major corporations is no small potatoes, they are nothing compared to increased expenses due to poor location and/or increased margins from choosing the right location. The most important considerations are access to vendors, transportation infrastructure, and an employable workforce.

- The tax structure of ten states allows for a corporation to use the property tax exemption it receives to offset its corporate state income tax liability AND apply excesses to another property it operates in the state. For example, if a corporation receives an ITEP exemption valued at $1.5 million, and their income tax liability is $1 million, they can apply the additional $500,000 to another property; even if it didn’t receive an exemption. In some cases, a corporation can reduce its tax liability to a negative and receive a rebate from the state. Both of these things are true in Louisiana.

I think most would agree that is not possible for any local school district with a mission statement that endeavors to maximize educational possibilities to reconcile that mission with giving up large portions of its revenue. It is not the role of school district to “stimulate the economy.” Their job is to produce an employable workforce pool that will stimulate the economy, when employed. They can’t do both.

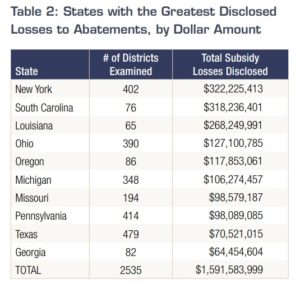

It is worth noting that the vast majority of states do not include taxes levied by school districts in its exemptions/incentives programs. In December 2018, Good Jobs First published a report that reveals that School districts in just 10 states—South Carolina, New York, Louisiana, Ohio, Oregon, Michigan, Missouri, Pennsylvania, Texas and Georgia—collectively lost nearly $1.6 billion. Three of the five MOST AFFECTED school districts in the nation are located in Louisiana for a total of $158 million in lost revenue. Thanks to new federal laws, school districts are required to self-report the amount of property taxes abated to business/industry. Unfortunately, there is no policing for the reporting. My school district reports as it should, and in the 2017 fiscal year, reported that about $44 million was abated to ITEP.

Now, it’s time to raise these questions.

- Will the people of Louisiana support a constitutional amendment that prohibits the inclusion of property taxes levied by local school boards in ITEP exemptions?

- Will business/industry stop the attacks on public education and support this amendment in exchange for all other exemptions at 100% without objection?

- Will business/industry commit to making invested efforts to maintain a rate of at least 75% of its workforce (permanent and contracted) permanent residents within a 30 mile radius of the job locale in order to maximum the “impact on economy?”

What do you say, business/industry? What are your priorities?