It is safe to say that the general public is unaware of the nuances of the budget battle taking place at the State Capitol, this week. On one side, the business lobby is applying pressure to its Republican legislators to maintain the State’s tax policies that benefit business and industry by providing exemptions for virtually all taxes; whether sales tax, or property tax. These are the policies that have driven the budget in the dirt, robbed K-12 education and higher education to the bone, and have created an unstable economy that relies heavily on sales taxes paid by individuals. On the other side, Democratic legislators, particularly the Black Caucus, are standing firm for reduced business/industry exemptions, a broader and more stable income tax base, in exchange for less sales tax. It’s all good. Both sides make good points, and some of them are representing their constituents in exemplary fashion.

Meanwhile, the same business lobby (Louisiana Association of Business and Industry aka LABI) is working behind the scenes in local governments to protect the property tax exemptions that business and industry has enjoyed, without restraint, for decades.

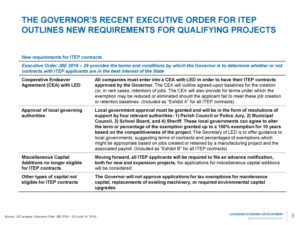

In June 2016, Governor John Bel Edwards signed Executive Order JBE 16-26 Conditions for Participating in the Industrial Tax Exemption Program. The EO established that no applications to the Industrial Tax Exemption Program (ITEP) would be approved without first getting approval from the local taxing authorities. This means that the application would have to be presented to each taxing authority for approval, and each taxing authority can approve fully, or partially, or they can deny it.

In December 2017, I wrote So You Want Choice? Choose!, after the Calcasieu Parish School Board passed an ITEP application for Phillips 66 with almost no questions asked. In the blog, I illustrate why Phillips 66 should not have received, yet another tax exemption, after 20 years of exemptions and a net loss of 100+ jobs. Shortly after I published that blog in December, I received a text from a contact at the Capitol telling me that the new ITEP figures were out for 2017, and that there was an “under the table” effort in Calcasieu to protect the ITEP exemptions for the local industries which is being led by the SWLA Economic Development aka Alliance SWLA aka LABI.

With the exception of a few school board meetings, I really have been focused on things at the legislature, and haven’t paid much attention to the local government entities. What they were saying, at the time, wasn’t really registering. It wasn’t until this article was published by Business Insider that I realized what was going on, and I needed to pay attention. The article describes an ad hoc committee that has been formed in Calcasieu Parish.

“The committee is led by either the president or vice president of the Southwest Louisiana Economic Development Alliance and includes representatives of the police jury, school board and sheriff, along with the relevant municipality if a project is within its borders. The representatives, all sworn to secrecy, meet with company officials and review LED’s project description before agreeing to a recommendation that member bodies would be expected to approve.”

I’m pretty proud of my investigative/research skills, and I’m very adept at googling and deconstructing. It didn’t take me very long to hash out some details of Calcasieu’s mysterious committee, and I am telling you, this is, without a doubt, circumventing the democratic process, questionably illegal, and most definitely unethical. We essentially have a representative from each taxing authority who meets with the committee and the company applying for the exemption. The group, which is led by George Swift, R. B. Smith (or both) discusses the exemption and then agrees “in good faith” to approve it. In the article mentioned above, Smith states,

“That takes the politics out of it. The feedback I’ve gotten so far [from industry] is, ‘Wow, we never thought this was going to work as well as it did.’” -R.B. Smith (Alliance SWLA)

What he really means by “takes the politics out” is that it assures passage before going to the authorities for a vote and minimizes public discussion. I’ve seen it. Phillips 66 breezed right through CPSB, and judging by the minutes, the Police Jury didn’t slow it down, either. Make no mistake. While the people involved in the committee aren’t elected officials, they are representing democratically elected boards and cannot commit formally, or informally, to approving an exemption.

The taxing authorities in Calcasieu parish are the bodies that have to approve ITEP applications. There are over 70 taxing authorities; however, they are not all affected by an exemption. In fact, most are not. It is only a handful that are called upon, and only if the property that the exemption is for lies within the boundary of the taxing authority, or adjacent to it. Below are the representatives that I have found, so far. It is vitally important that we all contact our school board members, police jurors, city councilmen, and sheriff to tell them that ITEP exemptions can no longer be blindly approved.

- Calcasieu Parish School Board: Wilfred Bourne. Resolution adopted and Bourne appointed at the August 15, 2017 regular board meeting. Pg. 10.

- Calcasieu Parish Police Jury: Tammy Bufkin. Resolution adopted and Bufkin appointed at the July 13, 2017 meeting. Pg. 4.

- City of Lake Charles: Adopted an ordinance at the February 7, 2018 meeting. In a separate resolution at the same meeting, Karen Harrell was appointed.

- Calcasieu Parish Tax Collector (Sheriff’s Office): Doesn’t have an elected body. The elected sheriff would appoint, and it appears to be Sharon Cutrera (unconfirmed).

- City of Westlake: States that have not adopted a resolution, or ordinance, nor have they heard of ITEP. With many of the industries being located adjacent to Westlake, I find this difficult to believe. In the absence of City Council action, I suppose it is likely that the city finance administrator would participate, since it appears that is who the other bodies selected. Can’t determine who that might be because their website leaves a lot to be desired.

- City of Sulphur: Also has not passed a resolution, or ordinance, and says they haven’t heard of ITEP. Also, impossible to believe. Unable to determine who is could be.

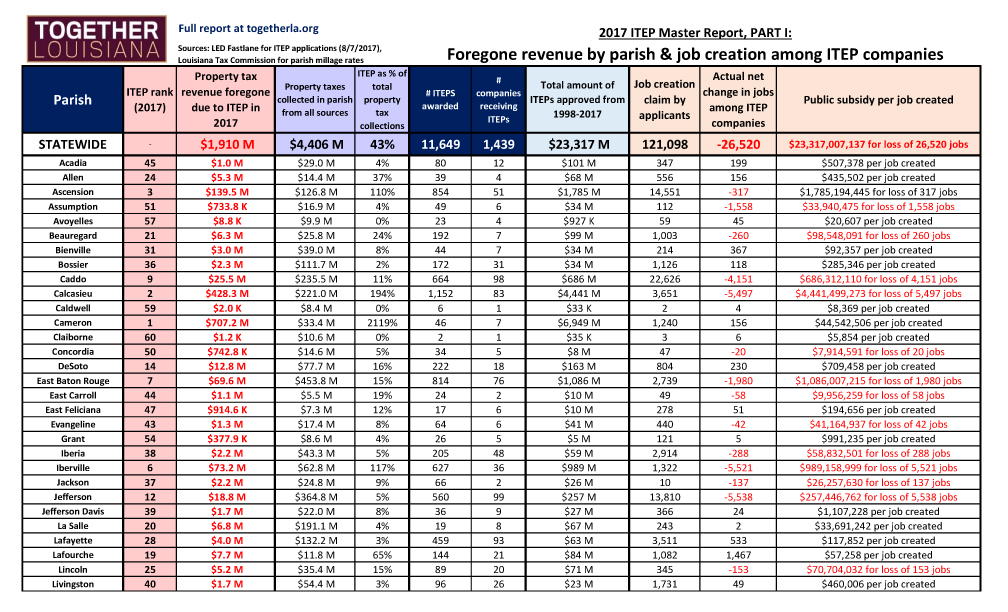

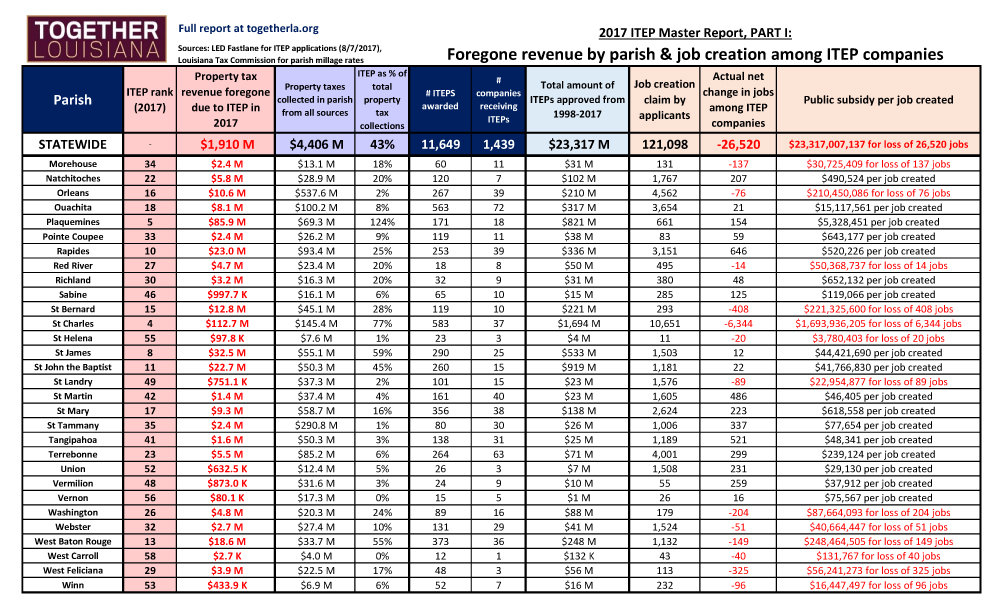

Just as a reminder of how much money these taxing authorities are giving away, you’ll find the graphic below. Remember these figures when you are being asked to pass sales taxes and/or property bonds.

Speaking to Ms. Cobb on the zoning committee, when ask when she thought the vote would come up for the ITEP in the parish, her response was the state would decide that, REALLY.

Wow even though the state grants the ITEP for the project your parish still has to vote for are against the tax and the percentage to be given. along with the Sherriff and School Boards.